At ActivBrokers.com, our mission is to offer a transparent trading environment with competitive spreads, fast execution, and exceptional service. Built by traders for traders, we prioritize your trading experience and success.

FAQ

Frequently Asked Questions

FAQ

General

How long has ActivBrokers been in operation?

ActivBrokers has been providing forex and CFD trading services since 2017, committed to delivering reliable and innovative trading solutions.

Is ActivBrokers a regulated broker?

Yes, ActivBrokers is regulated by the Financial Services Commission (FSC) of Mauritius, ensuring compliance with strict regulatory standards for client protection.

Is ActivBrokers an ECN/STP broker or Market Maker?

ActivBrokers operates as an ECN/STP broker, offering transparent pricing directly from top liquidity providers.

How can I verify ActivBrokers’ license?

You can verify our license through the FSC of Mauritius website or by contacting us for additional details.

What are the advantages of trading with ActivBrokers?

Advantages include ultra-low spreads, fast execution, high-quality platforms, and access to an ECN environment suitable for all trading strategies.

Where is ActivBrokers located?

ActivBrokers is headquartered in Mauritius, with a global client base and dedicated support team.

What services does ActivBrokers offer?

We offer forex and CFD trading services, educational resources, and various account types for both retail and institutional traders.

What is the minimum age to trade with ActivBrokers?

You must be at least 18 years old to open an account and trade with ActivBrokers.

Do I need any specific computer requirements to trade?

ActivBrokers’ trading platforms work on most modern devices. We recommend a stable internet connection for optimal performance.

Do you offer educational resources for investors?

Yes, we offer a range of educational resources, including webinars, tutorials, and market analysis.

How can I contact your customer service?

You can reach us via email, phone, or through our Help Centre, available from 8:00 am to 12:00 am, Monday to Sunday.

Investor Protection

Investor Protection

How are my investments protected under FSC regulations?

ActivBrokers adheres to FSC regulations, holding client funds in segregated trust accounts to protect your assets.

What is the Investor Compensation Fund (ICF)?

The ICF provides compensation (up to 50k per client) to retail investors in case of broker insolvency, under applicable regulations.

How can I file a complaint if I have an issue?

You may file a complaint through our support team or escalate it with the FSC if needed.

Is my personal data secure with ActivBrokers?

Yes, we prioritize data protection and utilize advanced security protocols to safeguard your information.

What should I do if I suspect fraudulent activity on my account?

Immediately contact our support team if you notice any suspicious activity on your account.

How do you use my personal information?

Your information is used solely to provide and improve our services and will not be shared with third parties without consent, except as required by law.

Account and Investment Information

How do I open an account?

You can open an account by completing our online registration form and submitting the required documents.

How long does it take to verify documents?

Verification typically takes 1-2 business days upon submission of all required documentation.

What documentation is required to open an account?

You will need to provide identification (e.g., passport or ID card) and proof of address (e.g., utility bill).

What trading symbols are available?

ActivBrokers offers a range of forex pairs, CFDs on indices, stocks, commodities, and cryptocurrencies.

Can I open a corporate account?

Yes, corporate accounts are available. Contact us for details.

Can I open a joint account?

Yes, joint accounts are available for certain account types.

What base currencies can I use?

Accounts can be opened in USD, GBP, EUR, and other major currencies.

What account types do you offer?

We offer various account types, including ECN accounts and Islamic accounts.

Do you offer demo accounts?

Yes, demo accounts are available for clients to practice and test strategies.

How can I upload documents?

You can upload documents directly through our online portal during the account registration process.

How can I verify my account?

Submit the required documents, and our team will notify you once verification is complete.

What if I fail the appropriateness test?

You may need to undergo additional assessment or consider educational resources to improve trading knowledge.

How do I check my account balance?

Account balances can be viewed on the trading platform dashboard.

What if my personal information changes?

Contact support to update any personal details associated with your account.

How can I log in to my account?

Log in using the credentials provided upon registration on our trading platform.

How can I close my account?

To close your account, contact our support team for assistance.

How can I change my email address?

Email updates can be requested through the client portal or by contacting support.

What is Margin?

Margin is the collateral required to open and maintain a leveraged position.

What is a Margin Call?

A Margin Call occurs when your account balance falls below required levels, prompting action to restore margin levels.

What is Take-Profit?

Take-Profit is a trading order that automatically closes a position at a set profit level.

What is a stop-loss order?

A stop-loss order automatically closes a position to limit potential losses.

What is Leverage?

Leverage allows you to control a larger position with a smaller initial investment.

What is CFD?

A CFD (Contract for Difference) is a financial instrument that allows trading on asset price movements.

What Spreads do you offer?

ActivBrokers offers low, competitive spreads, starting from 0.0 pips on ECN accounts.

What commissions apply?

Commissions depend on account type and trading volume; details are available on our website.

What leverage is offered?

Leverage up to 1:30 is available for retail accounts, with higher options for professional clients.

How can I increase my leverage?

Professional traders can apply for higher leverage after passing an eligibility assessment.

What is a hedge position?

A hedge position involves opening positions in opposite directions on the same instrument.

Is free margin needed for a hedge?

No additional free margin is required to open a hedge position.

What is slippage?

Slippage is the difference between expected and actual trade execution prices due to market conditions.

What is Swap (rollover)?

Swap is the overnight interest rate difference applied to positions held overnight.

What is TIN?

TIN (Tax Identification Number) is an identification number for tax purposes.

What is a municipality document?

This document verifies residence and may be required for account verification.

What is an EA? Can it be used?

An EA (Expert Advisor) is an automated trading program, and it can be used on ActivBrokers’ platforms.

Where can I find trading hours?

Trading hours are available on the platform and our website.

Can I hold trades indefinitely?

Yes, positions can be held as long as required, subject to swap fees.

How can I calculate commissions?

Commission calculations are detailed on our platform and based on trade size and instrument.

How can I calculate swaps?

Swaps can be calculated using the values listed on our website or platform.

Where is the server located?

Our servers are located in data centers in New York and London.

Does ActivBrokers offer VPS?

Yes, we provide VPS options for clients needing continuous connectivity.

What does “old version” on the platform mean?

An “old version” notification indicates that an update is required.

What is WebTrader?

WebTrader is a browser-based platform for convenient, software-free trading.

My card expired, what should I do?

Please update your payment method through the client portal or contact support.

Can MT4 accounts be used on MT5?

No, MT4 and MT5 are distinct platforms; accounts cannot be transferred.

Where are holiday trading conditions displayed?

Holiday schedules are posted on our website and platform.

What does “invalid account” mean?

This error typically means incorrect login details; contact support for help.

Do you accept all trading strategies?

Yes, ActivBrokers supports all trading strategies, including scalping, hedging, and automated trading.

Can I deposit from my spouse’s account?

For security reasons, deposits must come from an account in the same name as your trading account.

Where do I pay taxes on my ActivBrokers trading profits?

ActivBrokers does not withhold taxes on your profits. Tax obligations are your responsibility based on your country’s tax laws.

Do you offer Islamic accounts?

Yes, we offer swap-free Islamic accounts to accommodate clients who require Sharia-compliant trading.

Do you offer bonuses?

Any promotional offers or bonuses are displayed on our website when available.

Can I share my account with someone else?

For security and compliance, accounts must not be shared. Each account is personal to the registered user.

Can I become an affiliate or partner?

Yes, ActivBrokers has an affiliate and partner program. Contact us to learn more about partnership opportunities.

What is the difference between MT4/MT5 and cTrader?

MT4, MT5, and cTrader offer unique features, but all provide access to our ECN pricing. MT4 and MT5 are MetaQuotes platforms popular for their Expert Advisors, while cTrader is known for its user-friendly interface and advanced charting tools.

Can I trade over the weekend?

Forex trading is closed over the weekend, but cryptocurrency markets are accessible 24/7.

What are the requirements to become a “pro trader”?

To qualify as a pro trader, you may need to meet certain experience and financial thresholds and complete an assessment.

What should I consider before applying to become a “pro trader”?

Consider increased leverage options and potentially higher risk. Make sure you understand the regulatory implications of being classified as a pro trader.

Deposit/Withdrawals

What is the minimum deposit at ActivBrokers?

The minimum deposit varies by account type. Details are available on our website.

Is it possible to sign up without depositing?

Yes, you can create an account without depositing initially, but funding is required to begin trading.

What currencies can I deposit in?

We accept deposits in multiple currencies, including USD, EUR, and GBP.

What deposit methods are available?

ActivBrokers supports deposits via bank transfer, credit/debit card, and e-wallets like Skrill and Neteller.

Is it possible to lose more money than I deposited?

With our negative balance protection, you cannot lose more than your account balance.

How do you keep client funds safe?

All client funds are kept in segregated trust accounts with top-tier banks to protect your assets.

How do I deposit funds?

You can deposit funds through the client portal by selecting your preferred method and following the instructions.

How long does it take for my deposit to appear in my account?

Processing times vary depending on the deposit method, generally ranging from instant to a few business days.

How can I withdraw funds?

Log in to the client portal, select “Withdraw Funds,” and choose your withdrawal method.

Can I cancel my withdrawal?

Yes, pending withdrawals can be canceled through the client portal.

How long does withdrawal processing take?

Withdrawals are typically processed within 1-2 business days, though timing may vary by method.

Can I withdraw while I have open positions?

Yes, but sufficient margin must remain in your account to support any open trades.

What are the withdrawal fees?

Withdrawal fees depend on the method used and are listed in the client portal.

What if my funding account is canceled?

Contact support to arrange an alternative method for withdrawal if your original funding source is no longer active.

Why is my deposit showing as “Incomplete”?

This may be due to network issues or incomplete information. Contact support for assistance.

What if my deposit is declined with “Exceeds withdrawal limit”?

Your bank may have set limits; contact them for clarification.

What does “Do not honour” mean for declined deposits?

This message suggests your bank declined the transaction; please check with your bank.

What if my card/e-wallet is charged but my deposit is declined?

Contact support if funds are debited but do not reflect in your trading account.

How can I track bank wire or card withdrawals?

Tracking information and updates on withdrawal status are available through the client portal.

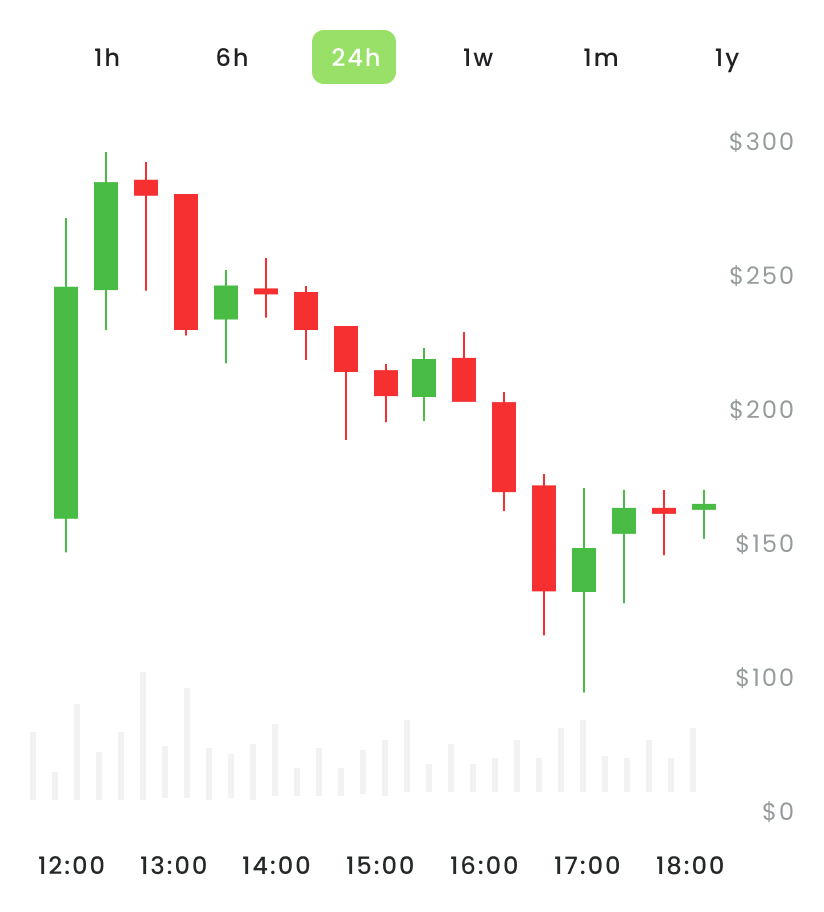

Trading Platforms (ActivBrokers Proprietary Platform with TradingView)

Are your platforms compatible with Mac?

Yes, ActivBrokers’ proprietary platform, integrated with TradingView, is fully compatible with Mac, Windows, and mobile devices, allowing seamless access across various systems.

How can I download the trading platform?

Our proprietary platform with TradingView is accessible via our website. You can download the app or use the web-based platform without additional software installation.

How do I log in to the trading platform?

Log in using the credentials provided during registration on the ActivBrokers platform.

How do I place a new order?

Orders can be placed directly on the platform by selecting your desired instrument and using the intuitive TradingView charting interface.

How do I close a position?

To close a position, simply select the position within the platform and click “Close” for quick, hassle-free execution.

Where can I view my account balance and trade history?

Your account balance and trade history are easily accessible on the platform dashboard, with detailed trade logs available for review.

How can I change the platform password?

Password updates can be managed within the platform settings, or contact support if you need assistance.

Our platform, powered by TradingView’s advanced charting and analysis tools, provides a robust trading environment for both novice and experienced traders.

Fees and Charges

What are the fees associated with ActivBrokers services?

ActivBrokers offers transparent, low trading fees, with details depending on the account type. You can view specific fees for commissions, spreads, and swaps on our website.

Are there any hidden charges?

No, ActivBrokers does not impose hidden charges. All applicable fees are clearly listed in the account terms and on the website.

"Empowering clients for informed trading success – innovation, integrity, commitment."

Juarez Cardoso

CEO of ActivBrokers

Secure Transaction

Ensuring fast, encrypted transactions for safe and secure trading experiences.

Global Markets

Access diverse global markets with top-tier liquidity and trading support.

FEATURES

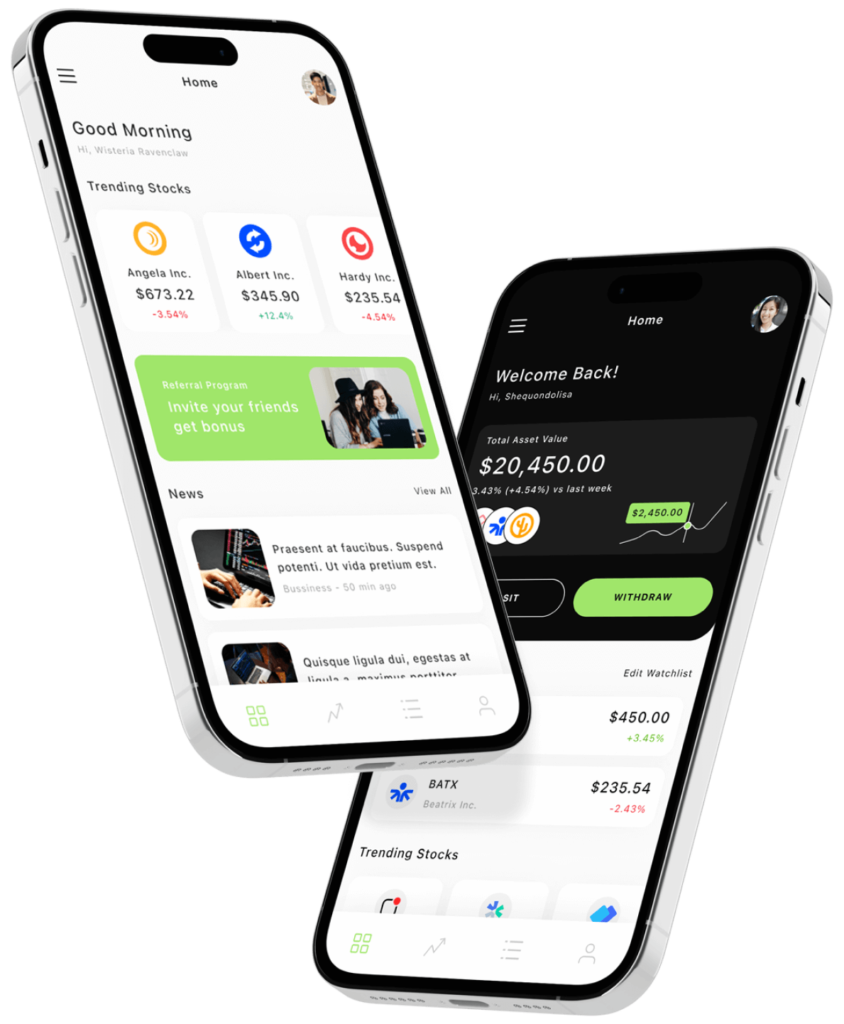

Our Platform Feature

Enhance your trading strategies with our powerful tools and technical indicators. Analyze trends, set entry points, and manage risk effectively with intuitive, professional-grade resources.

Accepting All Currency

More Than 600+ Trading Instruments

Trade 600+ instruments with tight spreads and fast execution.

Register Right Now & Get The Special Promo

Sign-in & Get 30-days Free Demo Account

- Privacy Policy

- Term & Condition

- Support

- Blog

Quick Link

- About Us

- Support

- FAQ's

- Contact Us

Get The App

ActivBrokers.com is a globally recognized trading platform offering access to a wide range of financial instruments, including forex, indices, commodities, and CFDs. Designed for both new and experienced traders, the platform combines intuitive user interfaces with powerful trading tools to support smart, confident decision-making.

Regulatory Framework:

ActivBrokers.com operates under a robust offshore regulatory structure that allows it to serve clients worldwide in full compliance with international standards. Our multi-jurisdictional framework ensures flexibility, client protection, and operational transparency, helping investors benefit from secure and seamless trading experiences regardless of their location. We adhere to strict due diligence and compliance procedures aligned with best practices in global financial services.

Risk Disclosure:

Trading leveraged products such as forex, CFDs, and other derivatives involves risk and may not be suitable for every investor. It’s important to consider your investment goals, level of experience, and risk appetite before engaging in trading. As with any investment, never trade with funds you cannot afford to lose.

Availability Notice:

ActivBrokers.com is committed to providing high-quality services to clients around the world. While we welcome traders from most jurisdictions, our services may be limited in certain regions where local laws or regulations restrict such financial activities. It is the client’s responsibility to ensure that the use of our services is in accordance with applicable laws in their country of residence.

Independent Guidance Recommended:

We encourage all clients to seek independent financial, legal, or tax advice before entering the financial markets. Information provided on ActivBrokers.com is educational and informational in nature and should not be considered investment advice.

Commitment to Client Success:

ActivBrokers.com is dedicated to helping clients achieve their trading goals through advanced technology, professional support, and a secure environment. Our platform is built for performance, trust, and long-term partnership — wherever you are in the world.

Copyright © 2023 ActivBrokers. All rights reserved.